Carlyle Group (CG)·Q4 2025 Earnings Summary

Carlyle Caps Record Year but Q4 Margins Disappoint, Stock Drops 5%

February 6, 2026 · by Fintool AI Agent

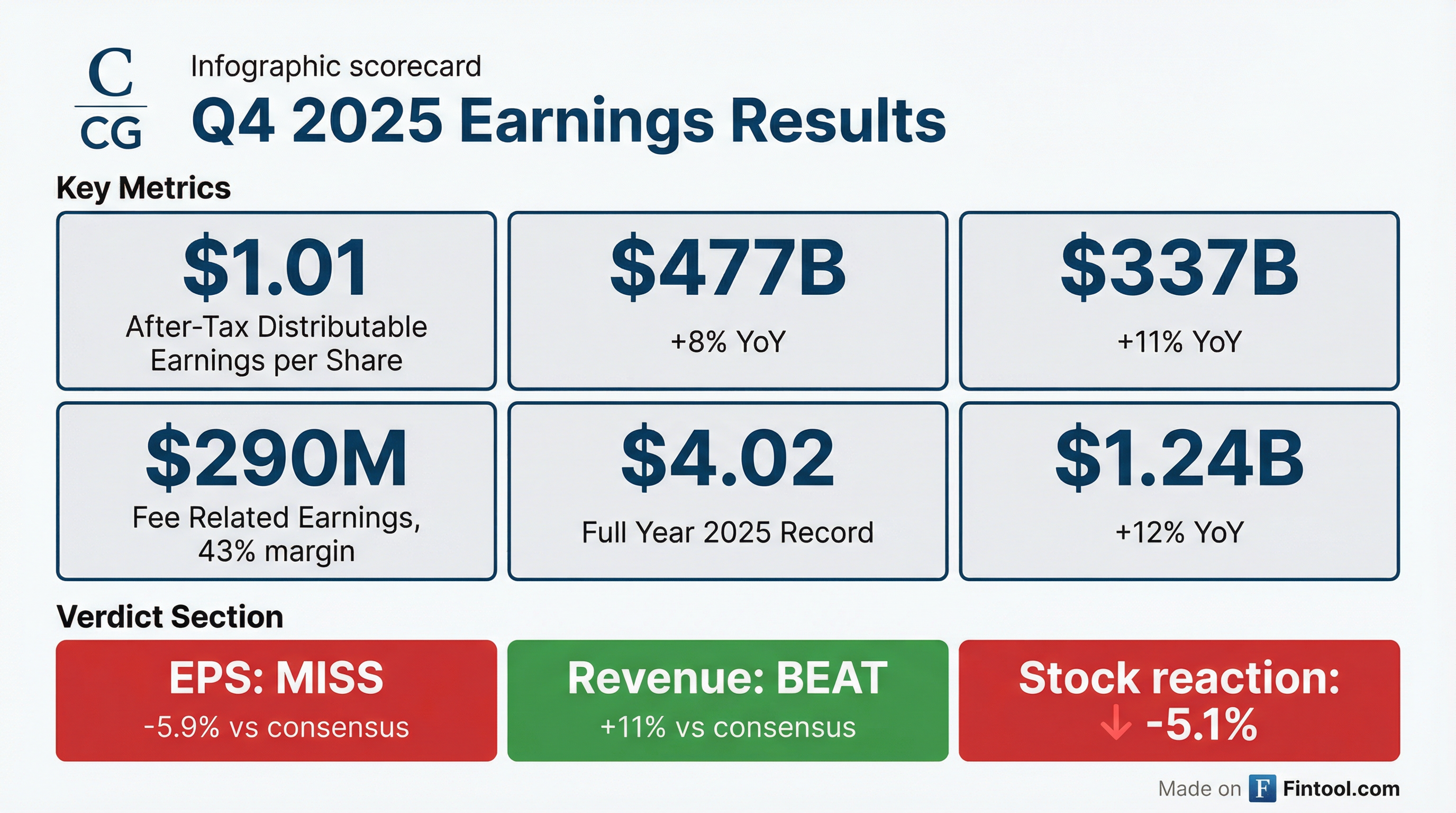

Carlyle Group delivered a record 2025 with full-year Distributable Earnings of $4.02 per share (+10% YoY) and Fee Related Earnings of $1.24 billion (+12% YoY), but Q4 margin compression sent shares down 5.1% on the day . After-tax DE per share of $1.01 missed Street expectations of $1.02 by roughly 1%, while total segment revenues of $1.09 billion beat the $980 million consensus by 11% .

Did Carlyle Beat Earnings?

The headline miss was slim, but the FRE margin contraction from 48% in Q3 2025 to 43% in Q4 2025 raised concerns . Q4 FRE of $290 million was essentially flat versus the $287 million generated in Q4 2024, despite an 11% increase in fee-earning AUM over the same period .

What Did Management Say?

CEO Harvey Schwartz struck an upbeat tone despite the stock reaction:

"2025 was a record year for Carlyle. We delivered record Fee Related Earnings, up 12% year-over-year... We generated $54 billion of inflows, again significantly outperforming our original $40 billion target."

On the macro environment and portfolio performance:

"When we look across all the companies that we own and interact with, the January data looks very good. So if you were just to look at that data, you would feel very good about GDP growth, margins, EBITDA generation."

Key highlights from the call:

- Record FY 2025 FRE: $1.24 billion, up 12% YoY, with record 47% margins

- Record inflows: $54 billion, well above initial $40B guidance

- Deployment acceleration: Record $54 billion deployed, up 25%+ YoY

- Realization strength: $34 billion in realized proceeds, up ~20% YoY

- #1 IPO sponsor: $10 billion of IPO issuance over past two years — more than any other firm

How Did Each Segment Perform?

Global Private Equity saw flat AUM as FY 2025 inflows of $7.5 billion and 7% appreciation were offset by $18.2 billion of realizations . The Medline IPO was the standout: $7 billion raised at a $49 billion equity valuation — the largest sponsor-backed IPO ever and the largest healthcare IPO in history. Today it trades 50%+ above IPO price . Fund appreciation was strong: U.S. buyout up 17%, Japan buyout funds up 30-60%, European technology up 20% .

Global Credit grew 10% YoY with $28.3 billion of FY 2025 inflows . Carlyle priced a record 39 CLOs in 2025, making it the most active CLO manager for U.S. activity . Direct lending had a record quarter of originations with ~$30 billion for the year . New hires include Alex Chi from Goldman Sachs as head of direct lending and Mike Mayer for origination .

Carlyle AlpInvest was the standout, delivering record FRE of $274 million (+60% YoY), almost 4x the level from two years ago . The platform closed its largest-ever secondary strategy at $20 billion and saw net accrued carry rise 21% YoY to $656 million .

What Changed From Last Quarter?

The quarter-over-quarter FRE decline from $312 million to $290 million, coupled with the 500 basis point margin drop, appears to be the primary driver of the negative stock reaction . This followed three consecutive quarters of FRE above $310 million.

However, Realized Net Performance Revenues surged to $123 million from $19 million in Q3, driven by exits in the U.S. buyout funds, Europe technology funds, and opportunistic credit .

How Did the Stock React?

CG shares fell 5.1% on earnings day, closing at $55.41 versus a prior close of $58.39. The stock recovered modestly in after-hours trading to $56.74 (+2.4% from the close).

The sell-off came despite the record full-year results and strong AUM growth. The market appears focused on:

- Margin compression: FRE margin fell from 48% in Q1-Q3 2025 to 43% in Q4

- FRE deceleration: Q4 FRE was the lowest quarterly reading of 2025

- Pending FEAUM decline: Down 26% YoY to $17 billion, potentially signaling slower future fee conversion

What Did Analysts Ask About?

On Software/AI Exposure (Goldman Sachs, Evercore): With recent volatility around AI and software valuations, analysts pressed on exposure. CFO Justin Plouffe: "Software investing has never been a big driver for Carlyle... Ours is 6% of total AUM, which I believe is below others." Harvey added they used "the broadest possible definition" to reach that 6% figure .

On Direct Lending Strategy (Evercore): Glenn Schorr asked about plans to grow direct lending. Harvey noted they've been "very systematic and thoughtful" about building out the platform, recently adding a new head of direct lending and senior origination professionals. The credit business has "more than 25 years" of experience through multiple cycles .

On CLO Resilience (Autonomous): Patrick Davitt asked about CLO software exposure and OC tests. Justin: "Our CLO performance has been among the best in the industry... I don't expect this recent volatility to affect them at all." Software exposure in CLOs is "right on top of the index" — not overweight or underweight .

On Wealth Channel Momentum (Citizens): Harvey highlighted the strategic pivot made three years ago, noting Evergreen Wealth AUM almost doubled YoY and headcount grew ~50%. The firm soft-launched CPEP, a private equity solution for individual investors, with select RIAs and hired a head of retirement solutions .

On Margin Expansion (UBS): When asked about segment margin drivers, Harvey emphasized: "What the team has done is pretty remarkable because they've managed to invest in the business, add resources, grow headcount, really reposition the platform, and drive the margins 1,000 basis points since the day I showed up" .

Balance Sheet & Capital Return

Carlyle issued $800 million of 5.050% senior notes due 2035 during 2025, bolstering its balance sheet .

Capital return: The Board declared a quarterly dividend of $0.35 per share, maintaining the $1.40 annual rate . The company repurchased $687 million of stock in FY 2025 (12.7 million shares) .

Forward Catalysts

- Shareholder Update (February 26, 2026): Management will share "multi-year financial targets, more insights into the strategic direction of the firm, and how we will continue to build on our success"

- Carry fund realizations: Net Accrued Performance Revenues of $2.9 billion remain available for future realization. Already signed or closed $7 billion of proceeds in corporate PE year-to-date

- Fundraising momentum: Record 2025 inflows position for continued fee growth with $88 billion of available capital across the firm

- Credit expansion: CLO business "well positioned" for another active year. Direct lending origination engine hitting on "all cylinders" with ~$30B in 2025 originations

The Bottom Line

Carlyle delivered on its 2025 promises with record FRE and DE, but Q4 margin compression and FRE deceleration spooked investors. The 5% sell-off creates an interesting entry point for those who believe the margin pressure is transitory. With $88 billion of available capital, $2.9 billion of accrued performance revenues, and a shareholder update in three weeks, the near-term catalyst calendar is active.

Full Year 2025 Scorecard:

- DE per Share: $4.02 (+10% YoY) — Beat targets

- FRE: $1.24B (+12% YoY) — Record

- Inflows: $53.7B (+32% YoY) — Record

- Total AUM: $477B (+8% YoY)